Products

Here is a quick overview of the different product categories and products YieldFlow is offering to its customers.

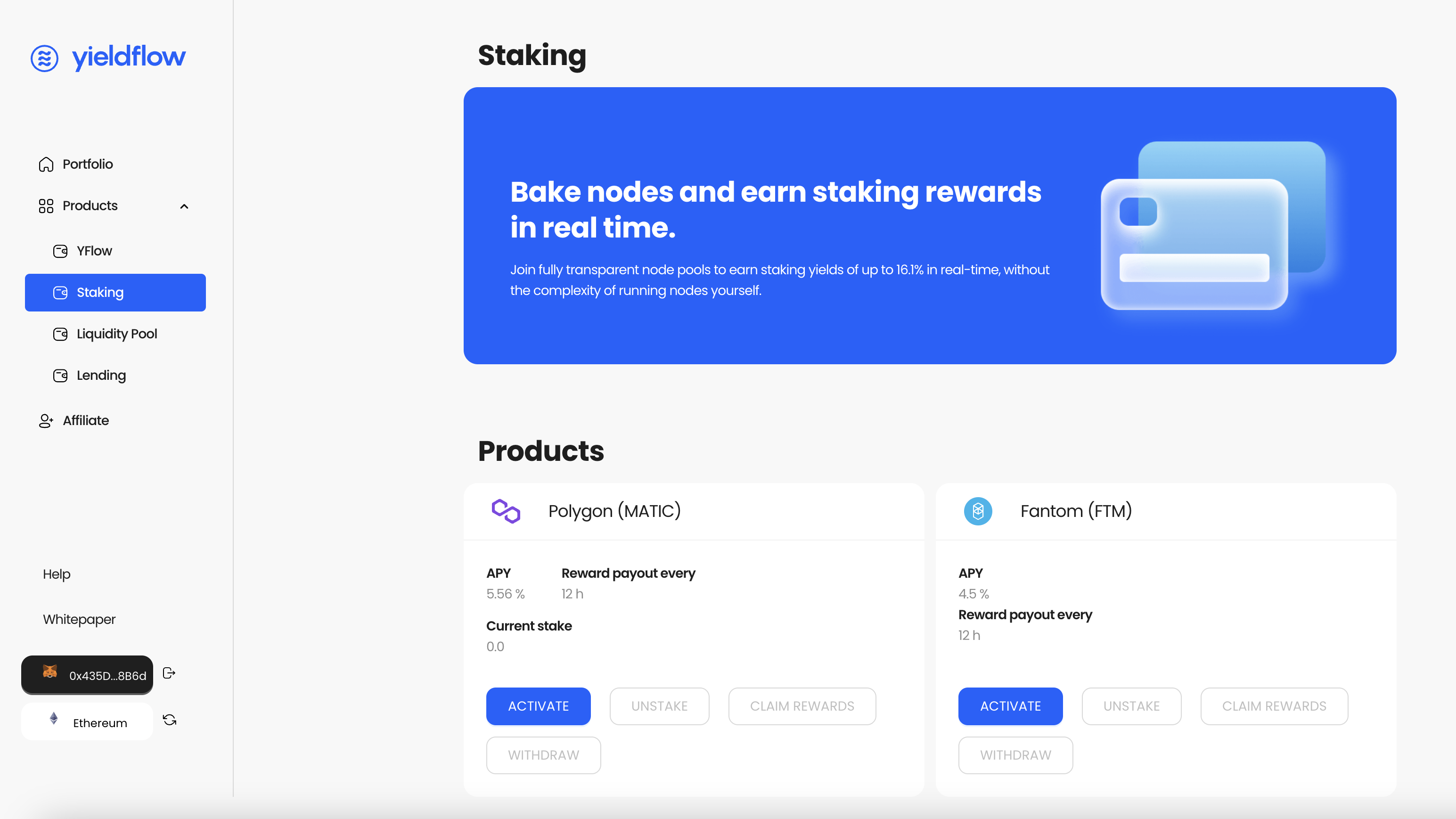

Staking

Staking is a process in which a cryptocurrency holder locks up a certain amount of their tokens to participate in maintaining the network's security and functionality. In exchange for staking their tokens, the holder may receive rewards in the form of additional tokens.

When someone stakes their tokens, they contribute to the blockchain network's consensus mechanism. This means they help validate transactions and create new blocks in the blockchain. Staking also helps prevent malicious attacks on the network by making it harder for bad actors to gain control of the required amount of tokens to carry out an attack.

In many staking systems, token holders who participate in the network's security are rewarded with additional tokens. The amount of tokens rewarded can vary depending on the staking system and the amount of tokens being staked.

Yieldflow is using a staking pool. This involves contributing your tokens to a larger pool of tokens, which are then used to validate transactions and create new blocks in the blockchain. In exchange for contributing your tokens to the pool, you receive a share of the rewards earned by the pool.

Currently Yieldflow offers staking and the staking rewards on the following projects:

- Polygon

- Fantom

- Aave

- Sandbox

- YFlow

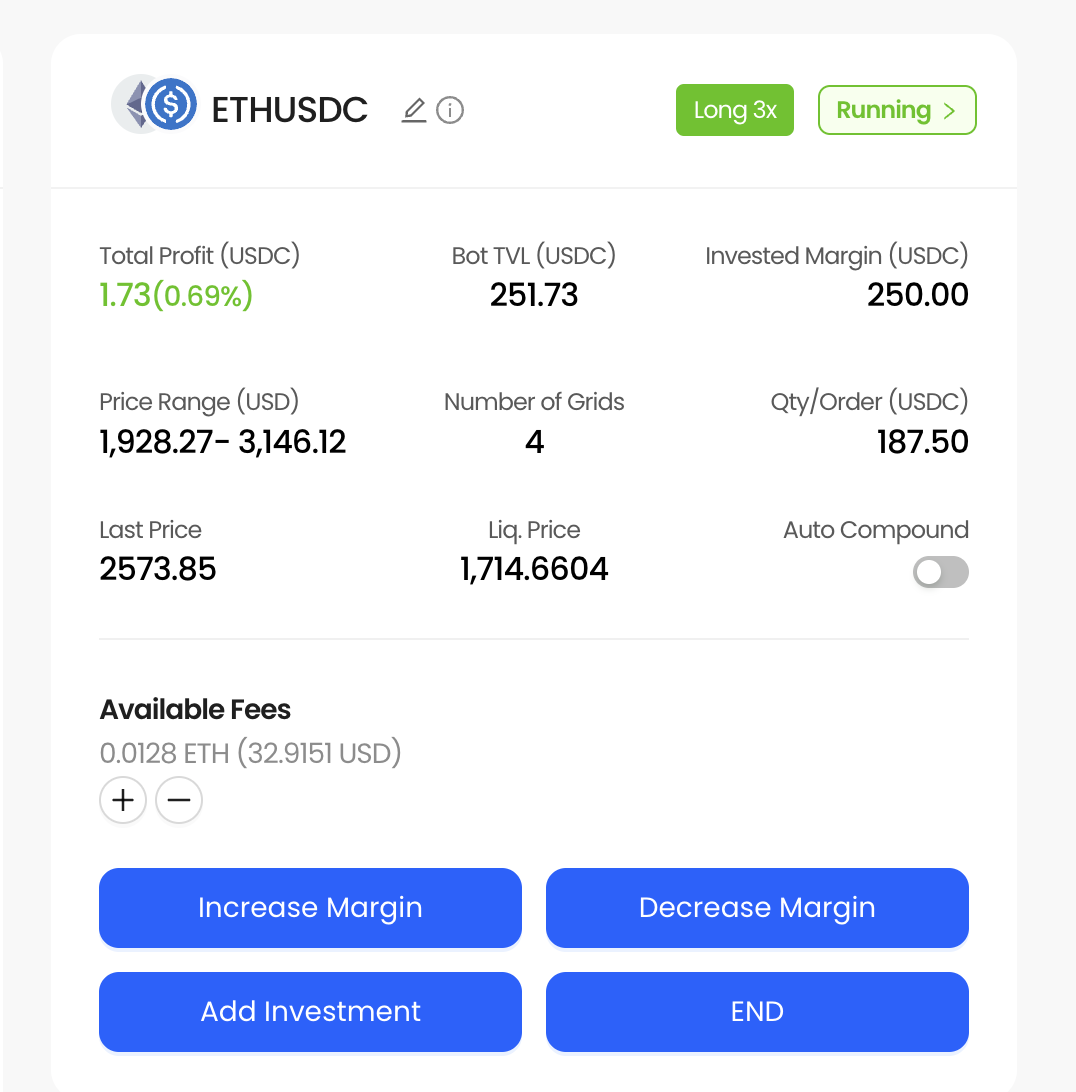

Future Grid Bot

Automate trading with an on-chain grid strategy. The bot places staggered buy and sell orders across a defined price range to capture volatility and compound gains.

Configure grid spacing, range, and allocation, or use AI-assisted presets. Run multiple bots, monitor P&L in real time, and stop anytime to reclaim funds.

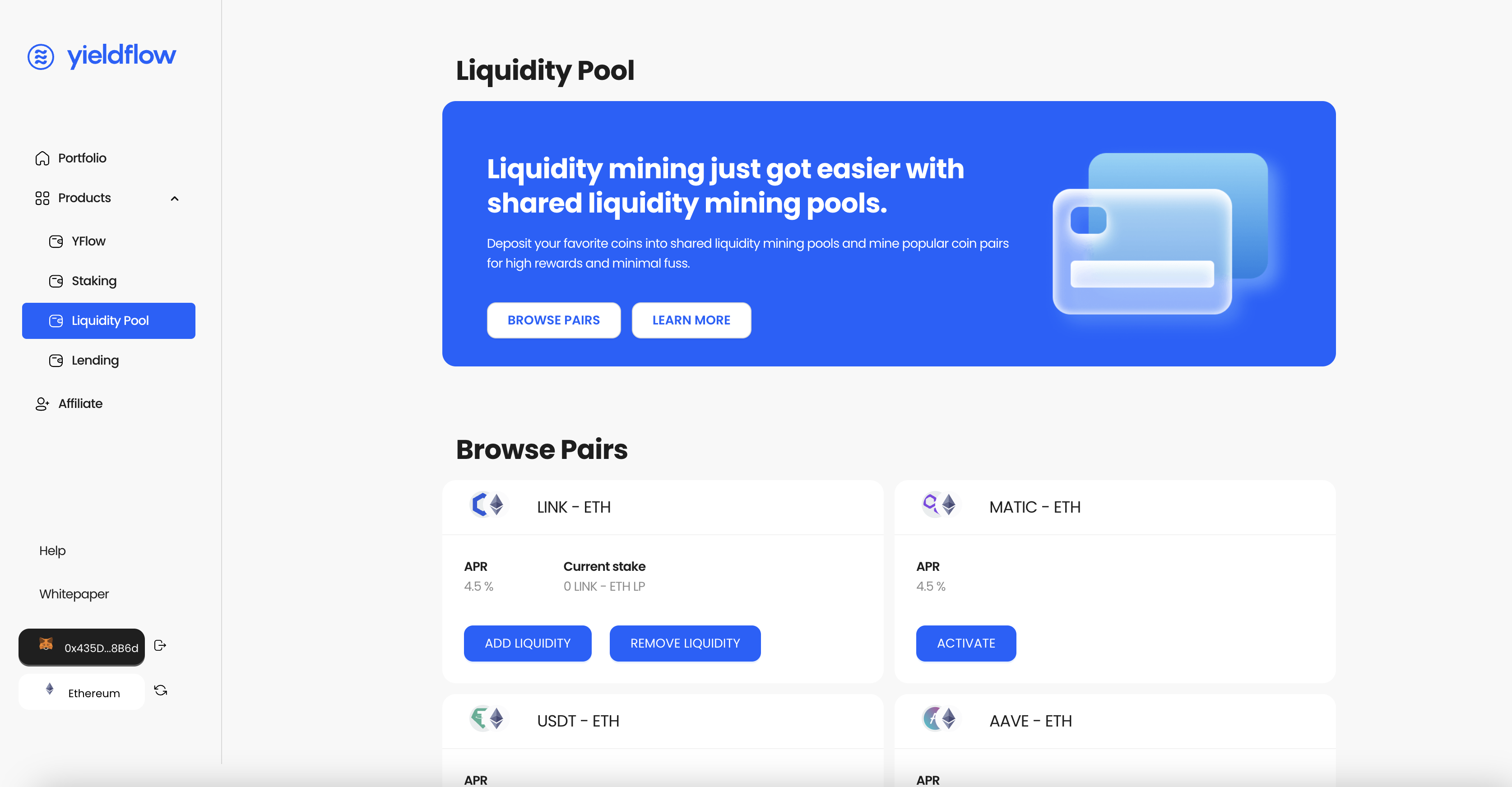

Liquidity Pools

Liquidity pools are a key component of decentralized finance (DeFi) ecosystems. They are pools of tokens that are locked into smart contracts and made available for trading on decentralized exchanges (DEXs).

In a liquidity pool, users deposit equal amounts of two different tokens, typically a base currency and a quote currency. For example, a liquidity pool may have a pair of tokens such as ETH/USDT, where ETH is the base currency and USDT is the quote currency.

The smart contract that governs the liquidity pool calculates the exchange rate between the two tokens based on their supply and demand. This allows traders to buy or sell one token for another within the pool without relying on a centralized exchange or an order book.

Traders who trade on a DEX pay a small fee, usually a percentage of the transaction amount, to the liquidity pool. These fees are distributed to liquidity providers, who are the users who have contributed their tokens to the pool.

By providing liquidity to a pool via Yieldflow, users can earn a share of the transaction fees generated by the pool.

Overall, liquidity pools are a fundamental component of DeFi ecosystems, as they provide a decentralized way to trade tokens without relying on centralized exchanges. They also provide an opportunity for users to earn passive income by providing liquidity to the pool.

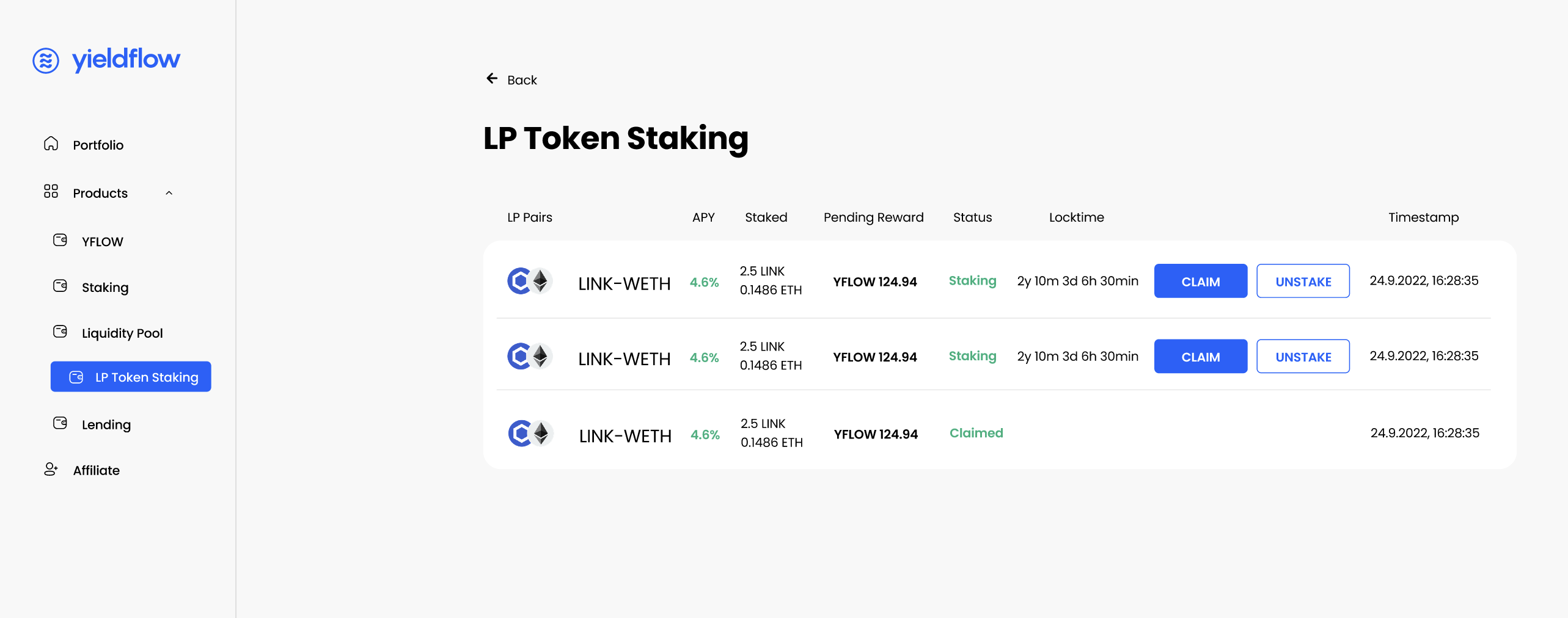

LP Token Staking

With our update it is now possible to stake the token generated by the liquidity pools.

After opening a liquidity pool you can click the button "Stake LP Token".

To find all previous activity simply click "LP Token Staking".

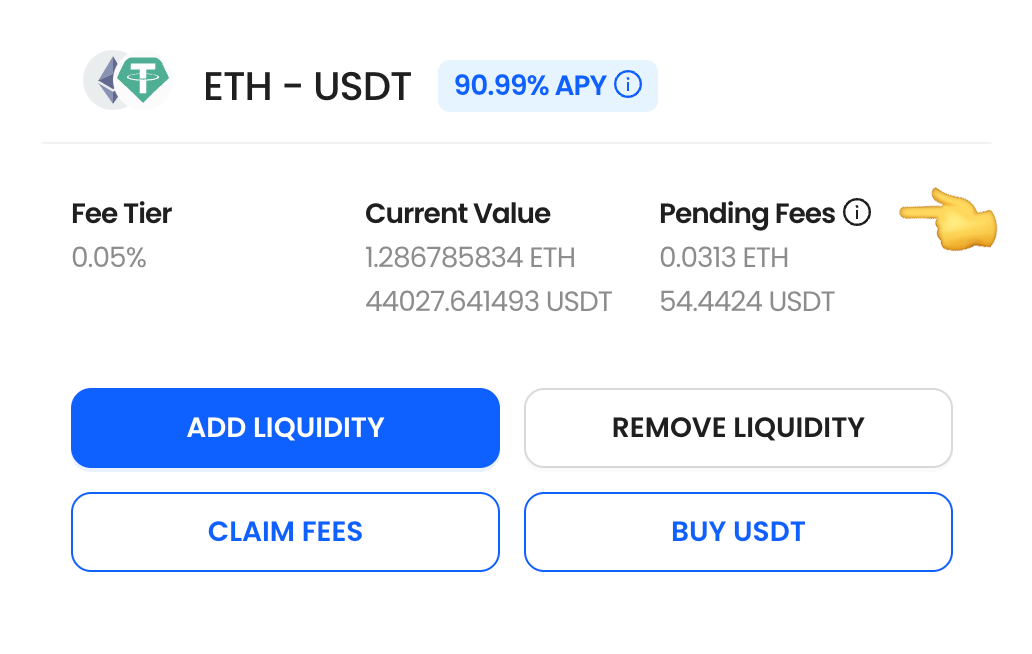

Liquidity Pools V3 🔥

Through a liquidity management protocol that fully automatically parameters the user's positions, DEX V3 can be automated anonymously, decentralized and securely. The protocol places the boarders very closely and keeps the user's position in range. This eliminates the impermanent loss almost entirely and increases the effectiveness of capital exponentially.

The V3 Liquidity Pools are currently offered on the Arbitrum Chain.

In order to use the products, the digital assets must be posted to the Arbitrum Chain, L2 of Ethereum.

If the output is fiat (USD, EUR), a withdrawal can be carried out from a CEX directly into the Arbitrum One Chain. If the assets are in the Ethereum Chain, they can be accessed using the Arbitrum Bridge https://bridge.arbitrum.io/ to be moved to the Arbitrum One Chain. The link can be found on YieldFlow.

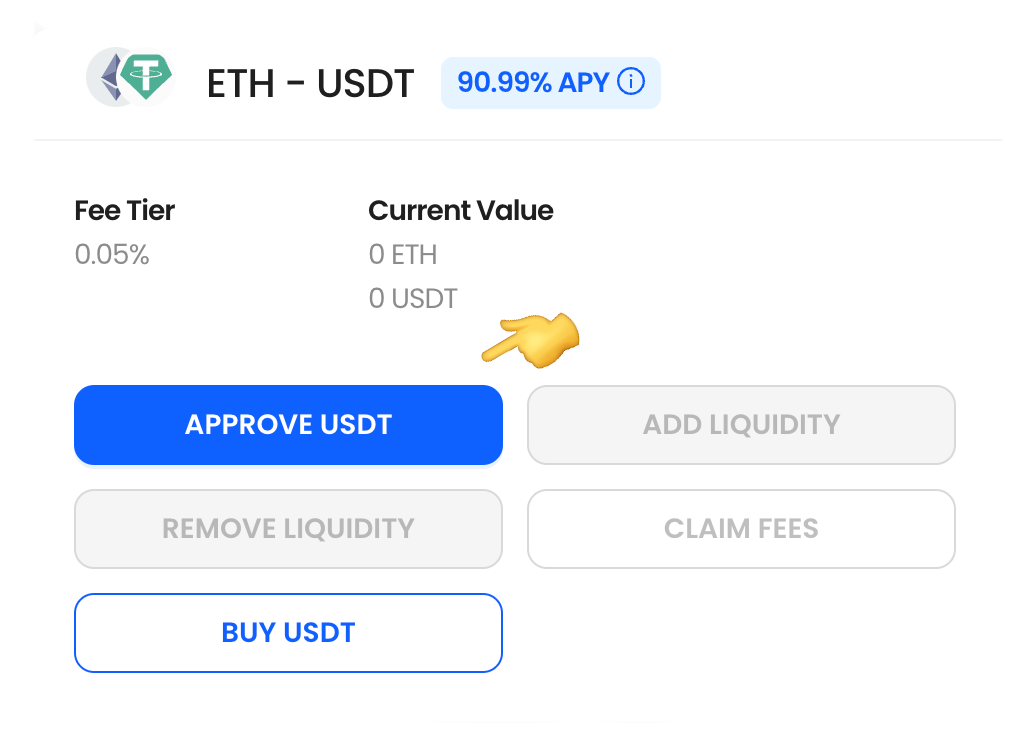

To start, the approval(s) must be carried out.

After successful approval, this button disappears and Add Liquidity is activated.

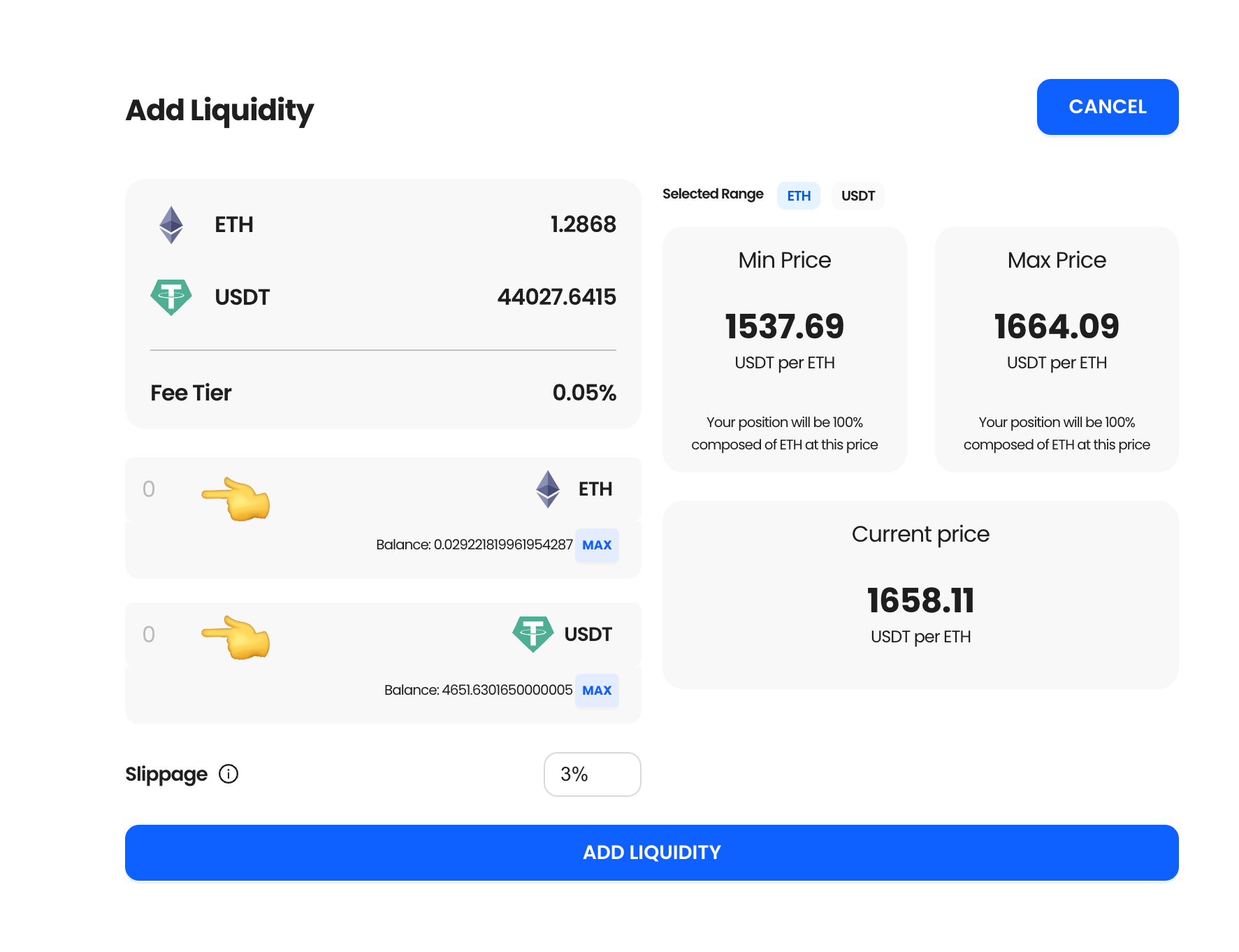

The following pop up window open immediately

Information such as the current status at the top left, top right, the fully automatic range for information and the current price ratio are displayed here. The number of assets is recorded at the bottom left of the rectangle. The first asset is recorded manually, the second is automatically calculated appropriately. With "max" you can select the maximum balance currently on the wallet for this asset.

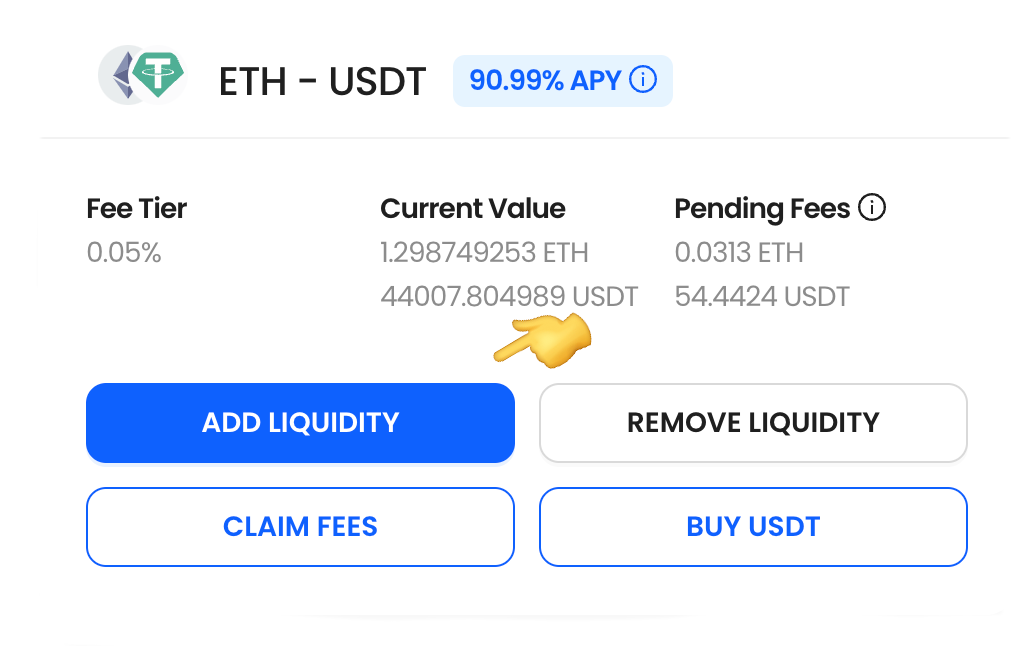

With "Add Liquidity" this is completed and the position is built up. The capital starts earning fees immediately, pending fees become visible after 24 hours. The fees are billed twice every day at 00:00 and 12:00 UTC and can be booked onto the wallet with "claim fees".

On Chain Future Grid Bot 🔥

The On Chain Future Grid Bot is YieldFlow's advanced automated trading system that uses grid trading strategies to capitalize on market volatility. Grid trading involves placing buy and sell orders at predetermined intervals above and below the current market price, creating a "grid" of orders that profit from price fluctuations.

Key Features

- Fully automated on-chain execution

- Advanced grid trading algorithms

- Real-time P&L tracking

- Multiple concurrent bot management

- Telegram integration for notifications

- NFT-powered enhanced features

Getting Started

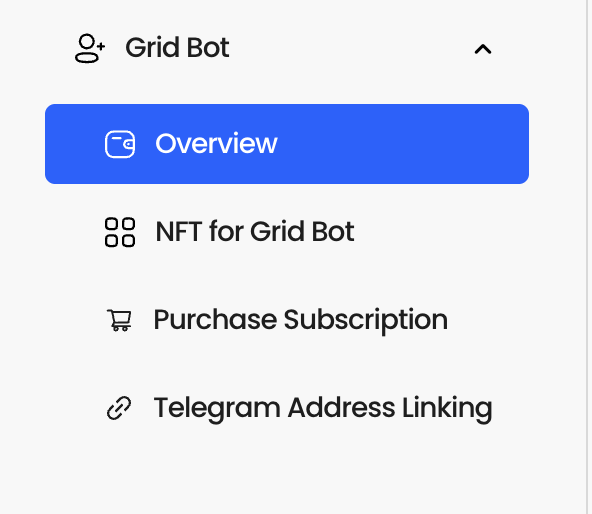

1. Accessing the Grid Bot Menu

Navigate to the grid bot section through the main YieldFlow interface menu. The grid bot feature is prominently displayed in the navigation for easy access.

2. Subscription Requirements

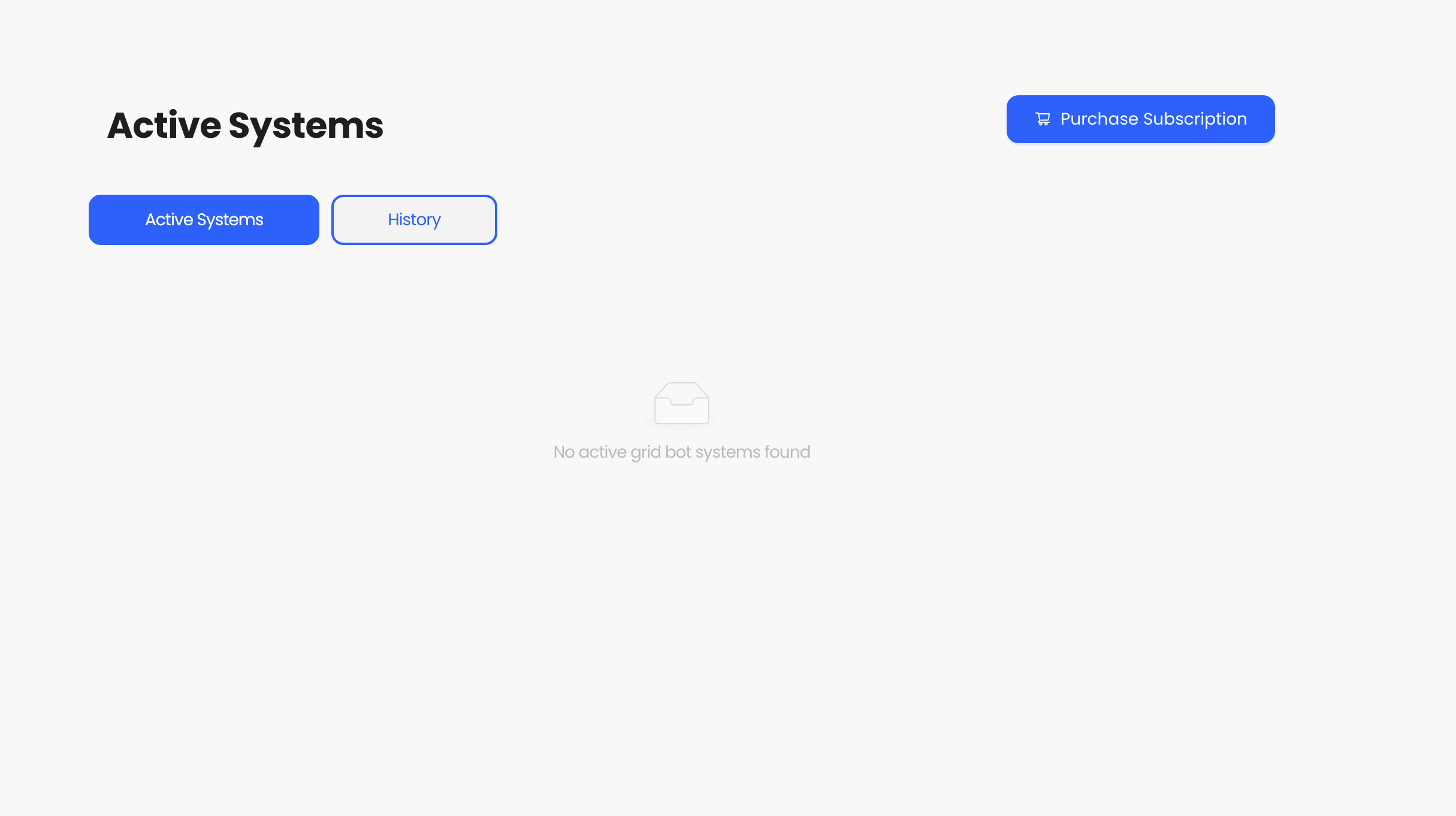

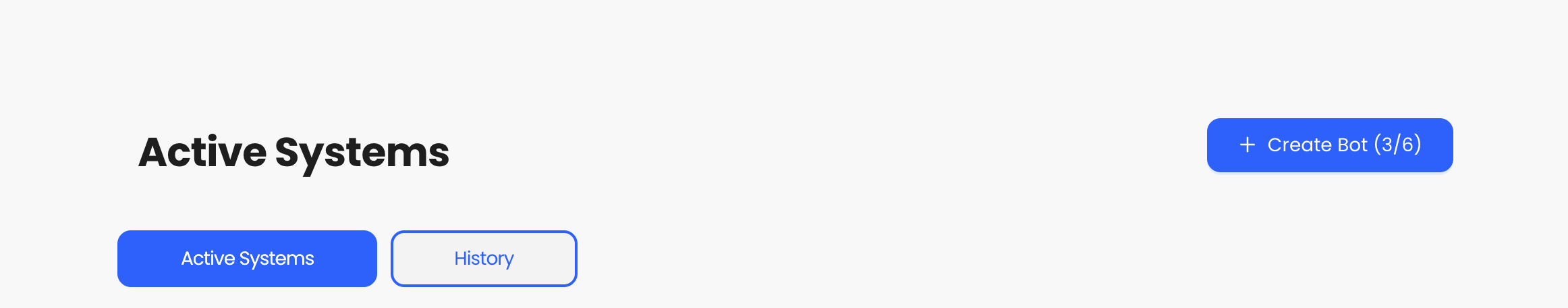

Before using the grid bot, you need an active subscription. The interface will show different states depending on your subscription status:

Before Subscription

After Subscription

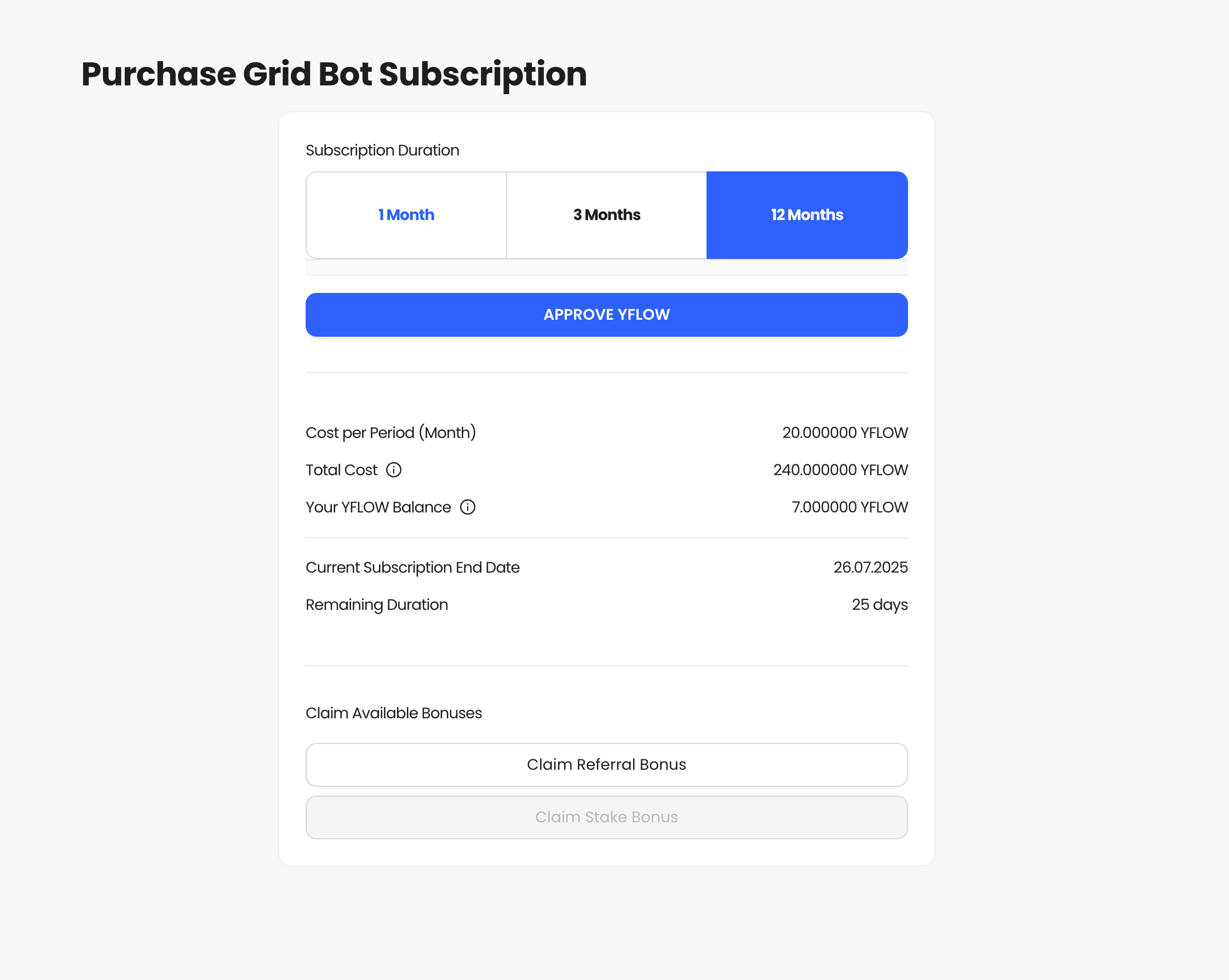

3. Purchasing a Subscription

To access the grid bot features, you'll need to purchase a subscription. The subscription interface provides clear pricing options and payment methods.

Subscription Interface Elements

- Duration Options: Monthly, quarterly, or annual billing

- Select Plan: Choose your preferred subscription tier

- Confirm Purchase: Finalize the subscription payment

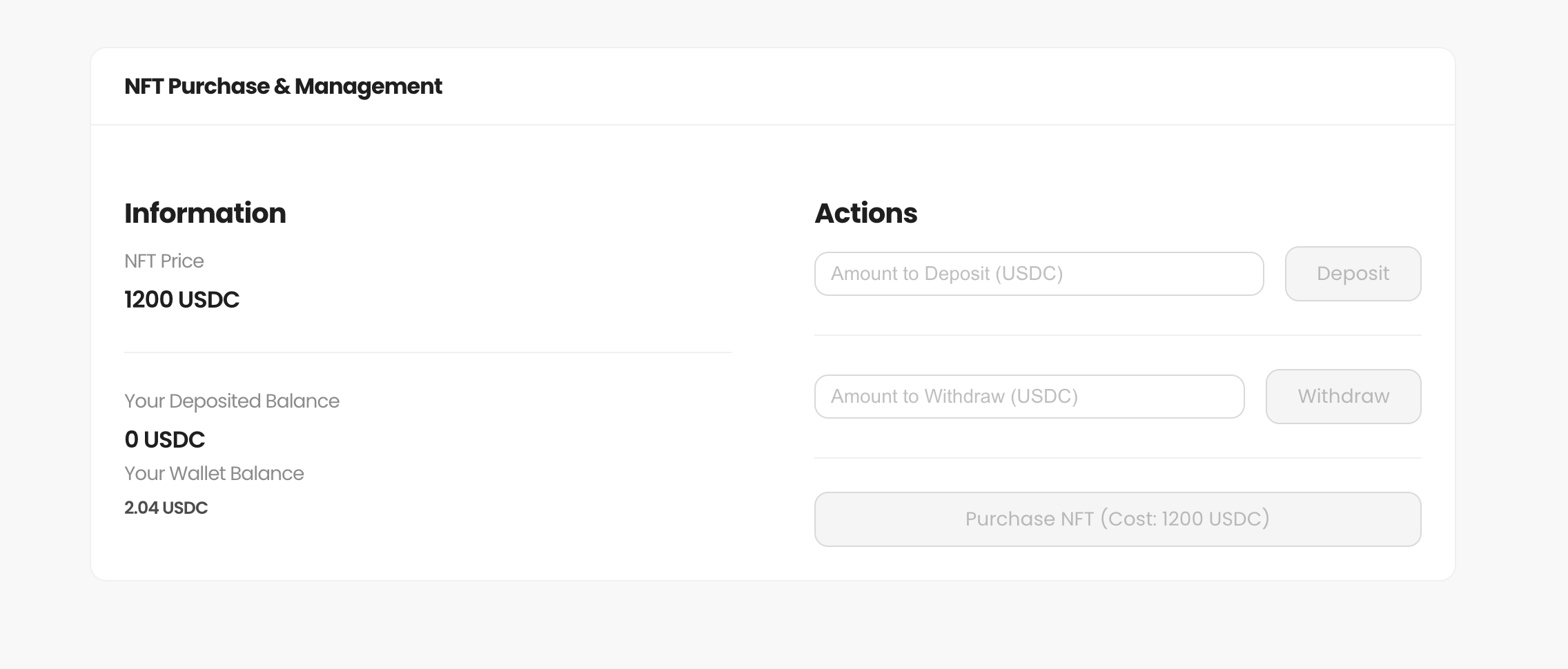

4. NFT Integration

For enhanced features and additional benefits, you can purchase and stake YTRADE NFTs. These NFTs unlock advanced functionality and higher yield potential.

Purchase NFT

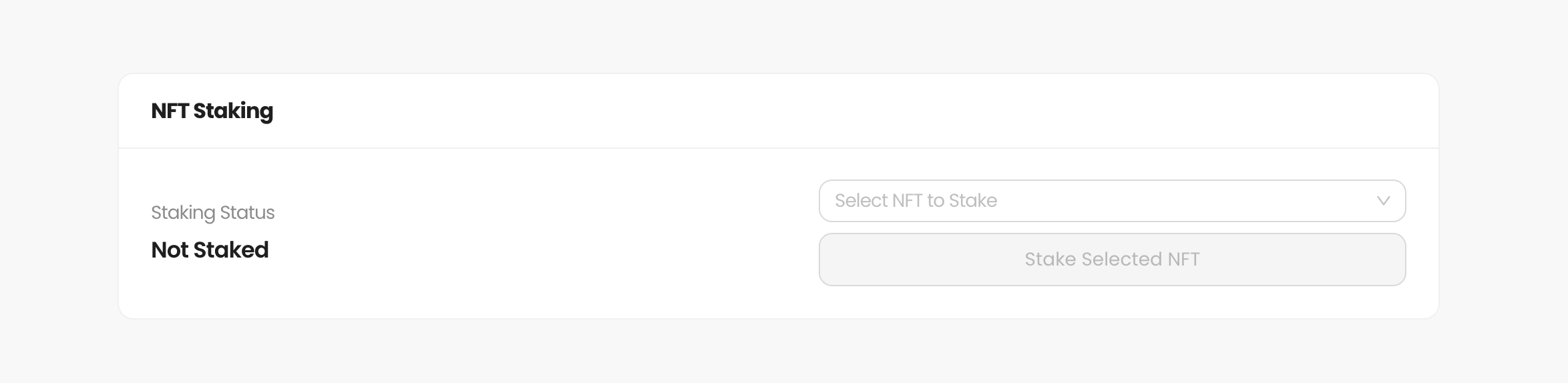

Stake NFT

NFT Staking Features:

- • Owned NFTs: Display of your YTRADE NFT collection

- • Stake/Unstake: Actions to manage your NFT staking

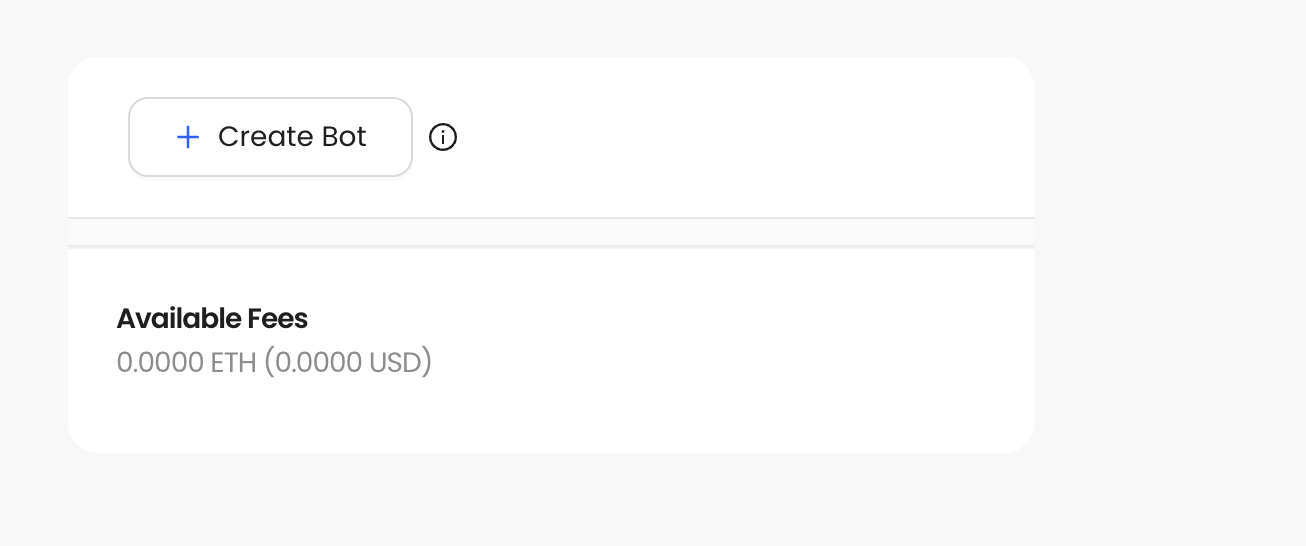

Creating Your First Grid Bot

1. Create Bot Button

Once you have an active subscription, you can create your first grid bot by clicking the create button in the interface.

2. Bot Configuration

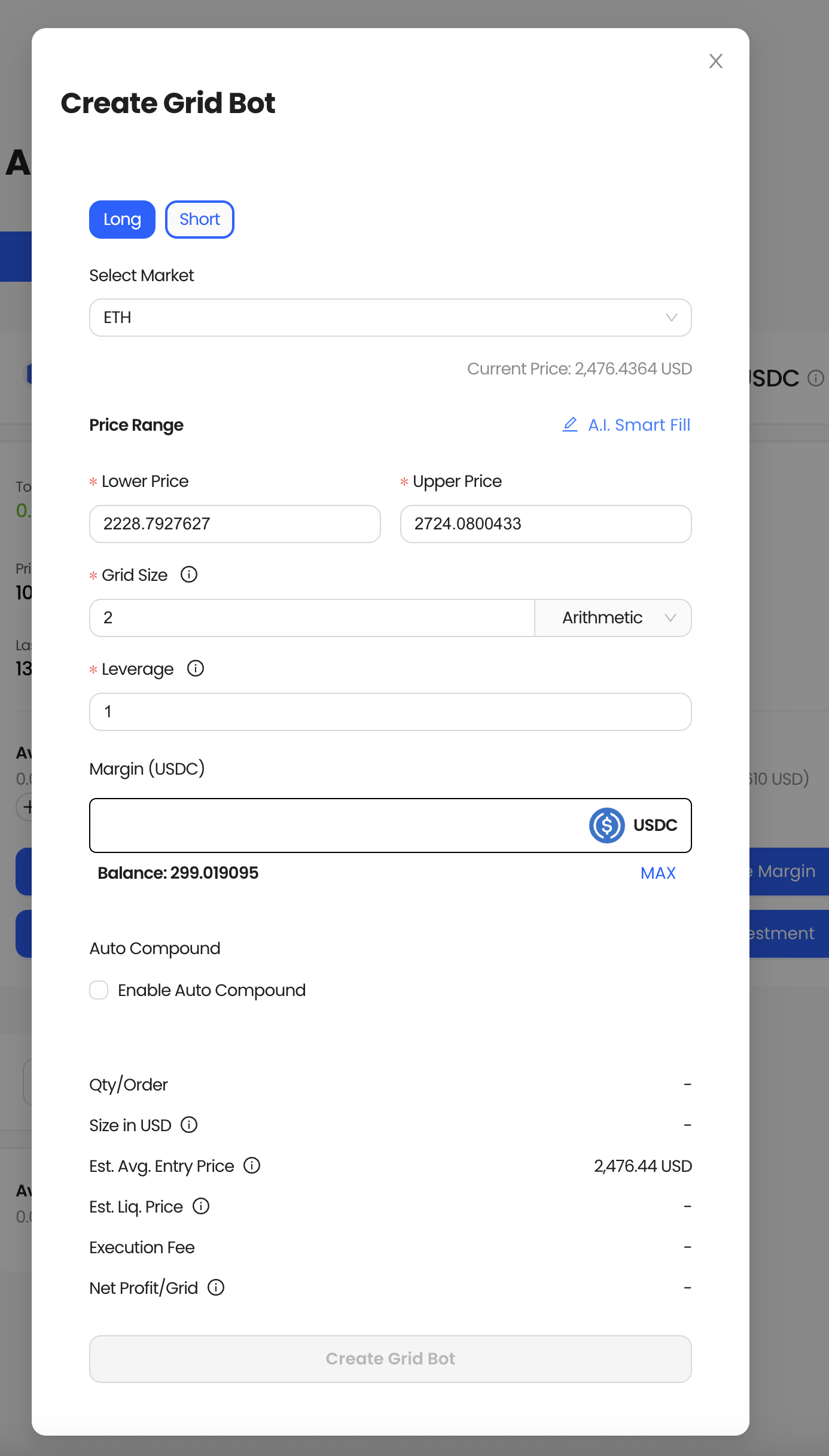

The create modal allows you to configure your grid bot parameters. Each setting controls how your bot will behave in the market.

Create Bot Modal Elements Explained

Choose the cryptocurrency pair you want to trade (e.g., BTC/USDC, ETH/USDC). This determines which assets your bot will buy and sell.

- Grid Spacing: The price difference between each buy/sell order in your grid

- Number of Grids: How many buy and sell orders to place above and below current price

- Price Range: Upper and lower bounds where your grid will operate

Total capital to allocate to this grid bot. The bot will distribute this across all grid levels.

- Auto Compound: Automatically reinvest profits to increase position sizes

Managing Your Grid Bots

Bot Overview

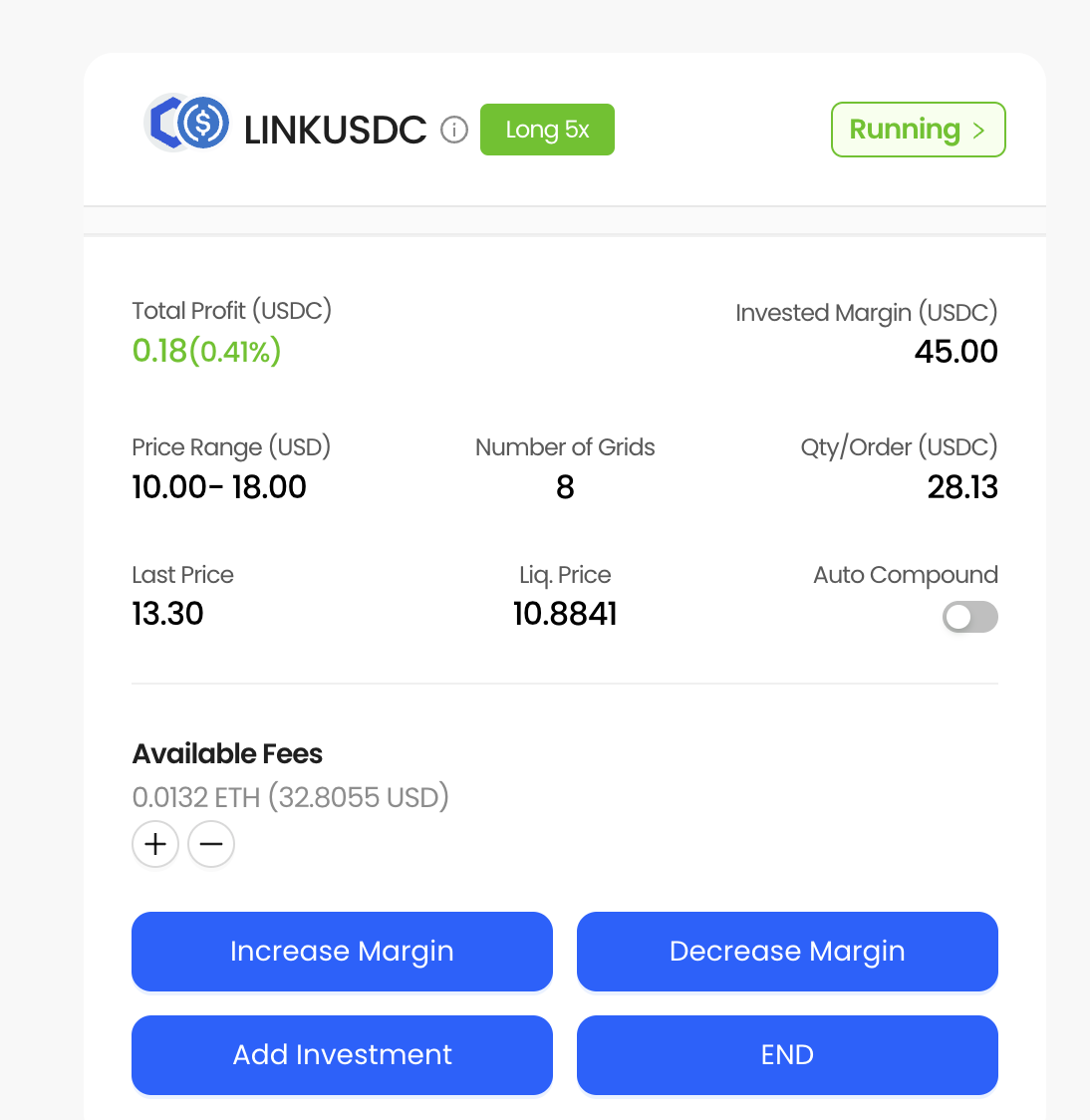

Each grid bot is represented by a card showing key metrics and current status. You can monitor multiple bots simultaneously from the main dashboard.

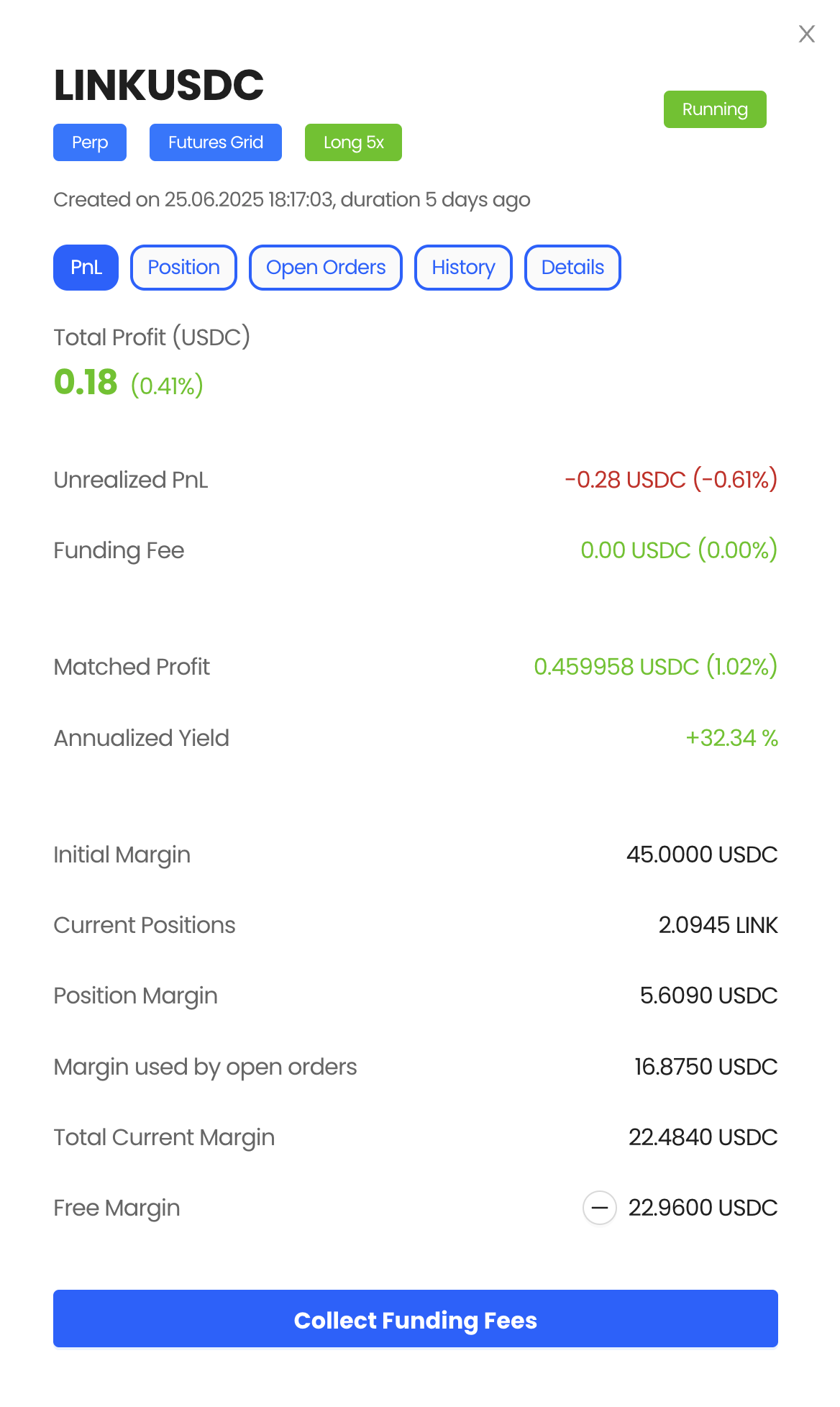

Detailed Bot Information

Click on any bot to access detailed information including configuration parameters, performance metrics, and management options.

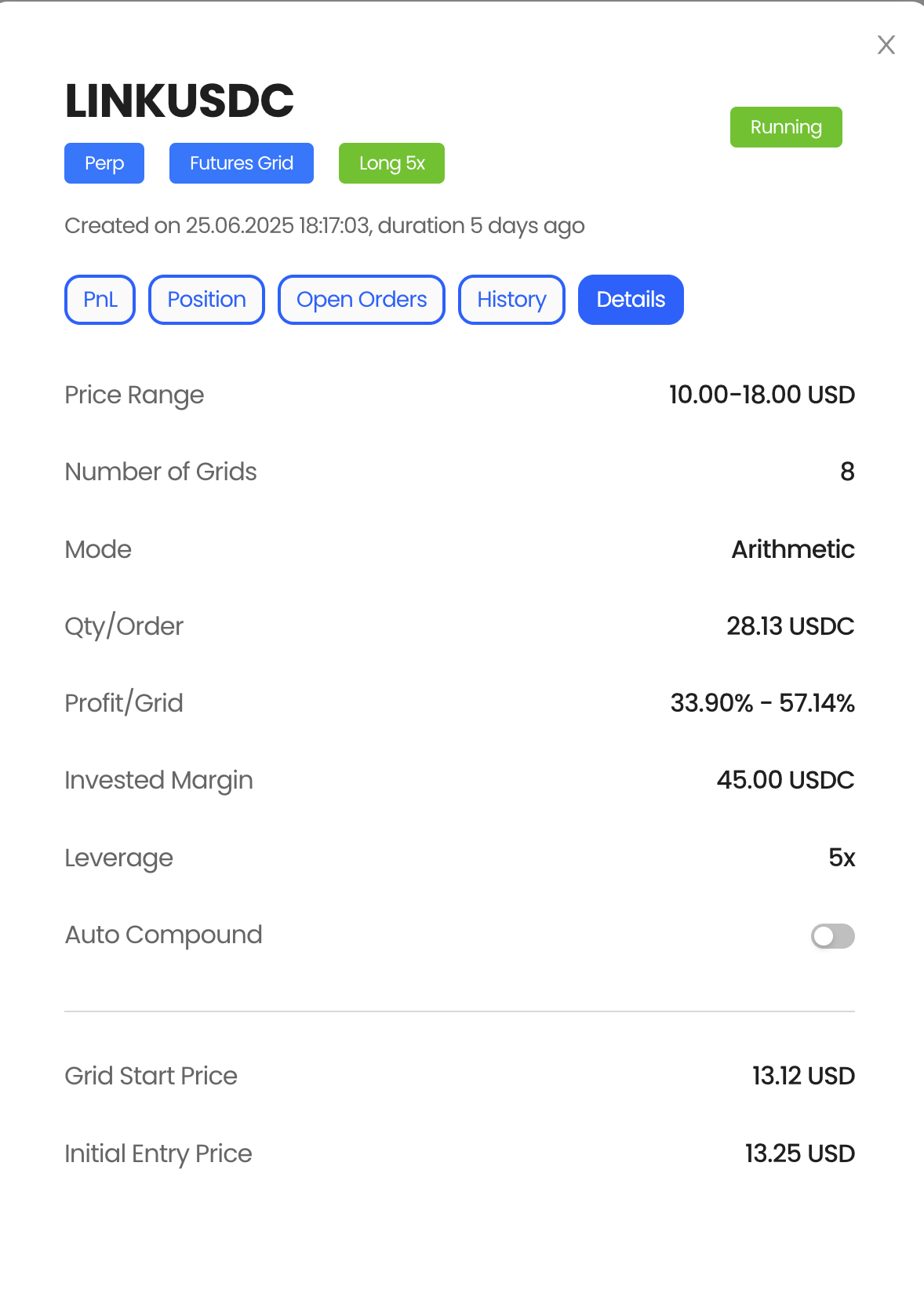

Bot Details Interface Explained

- Bot Status: Shows if the bot is Active, Paused, or Stopped

- Trading Pair: The cryptocurrency pair being traded

- Creation Date: When the bot was first started

- Runtime: How long the bot has been operating

- Total P&L: Overall profit/loss since bot creation

- P&L Percentage: Return on investment as a percentage

- Today's P&L: Profit/loss for the current day

- Active Grids: Number of currently active buy/sell orders

- Grid Spacing: Current price difference between grid levels

- Price Range: Upper and lower price boundaries

- Investment Distribution: How capital is allocated across grids

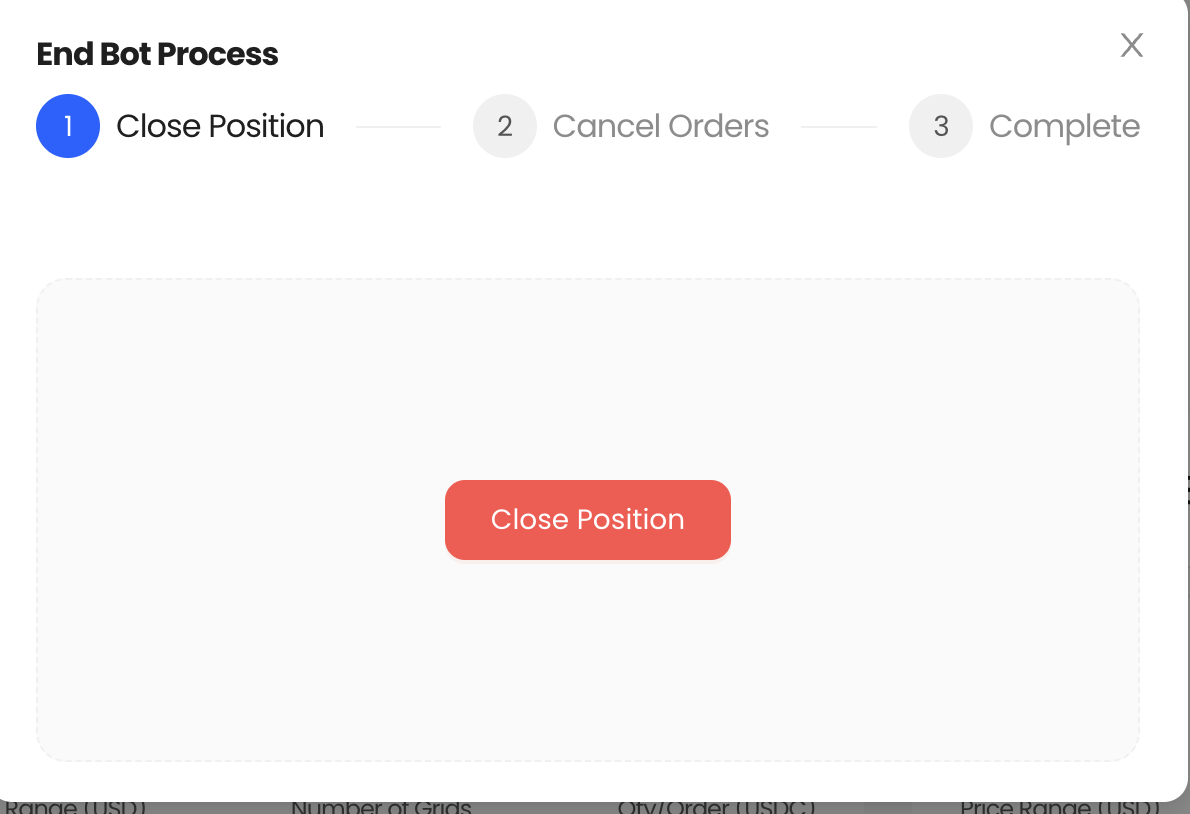

- End Bot: Permanently stop the bot and withdraw funds

- Current Price: Live market price of the trading pair

Performance Tracking

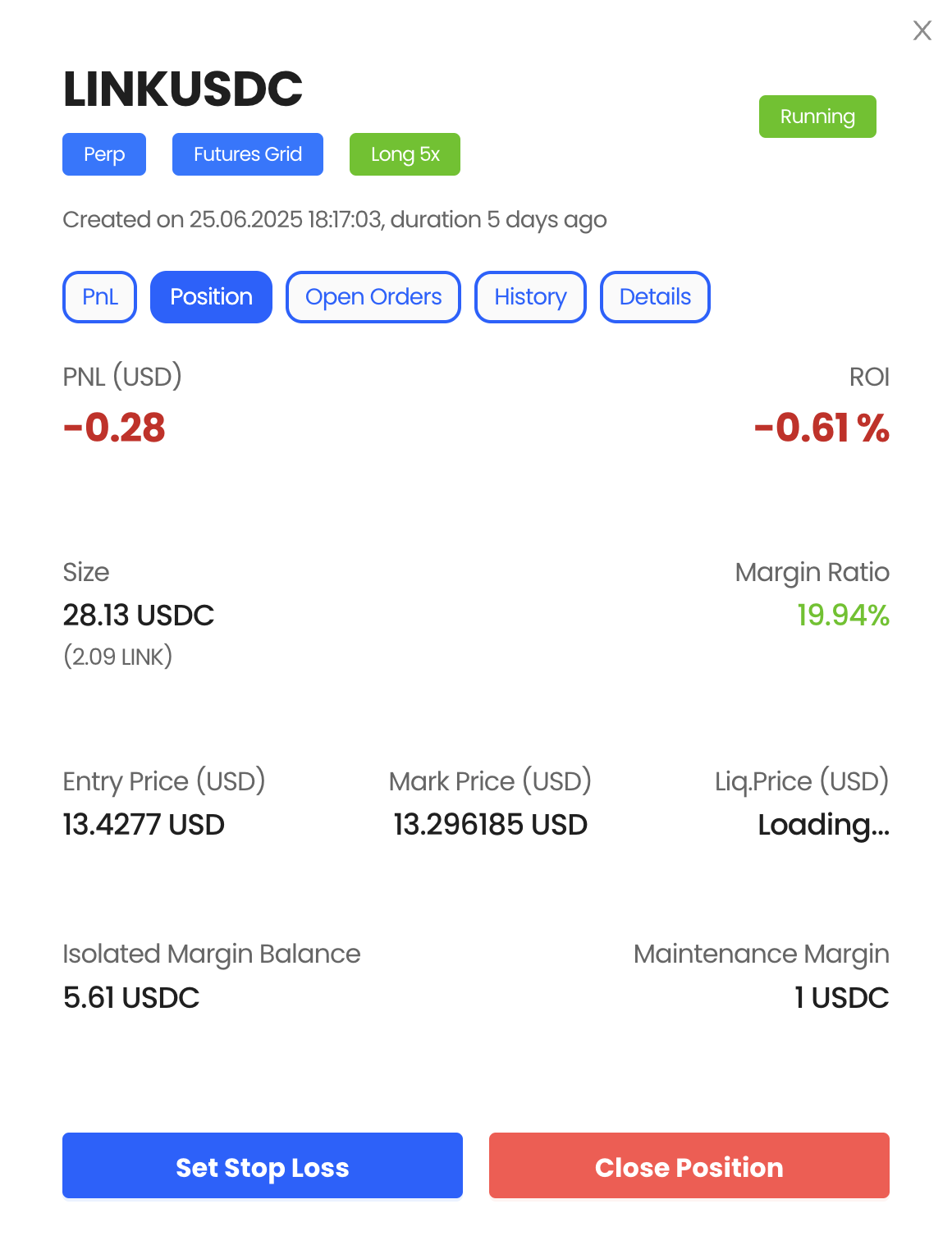

Current Position

Monitor your bot's current position and asset allocation in real-time.

Profit & Loss (P&L)

Track your bot's performance with detailed P&L analytics and charts.

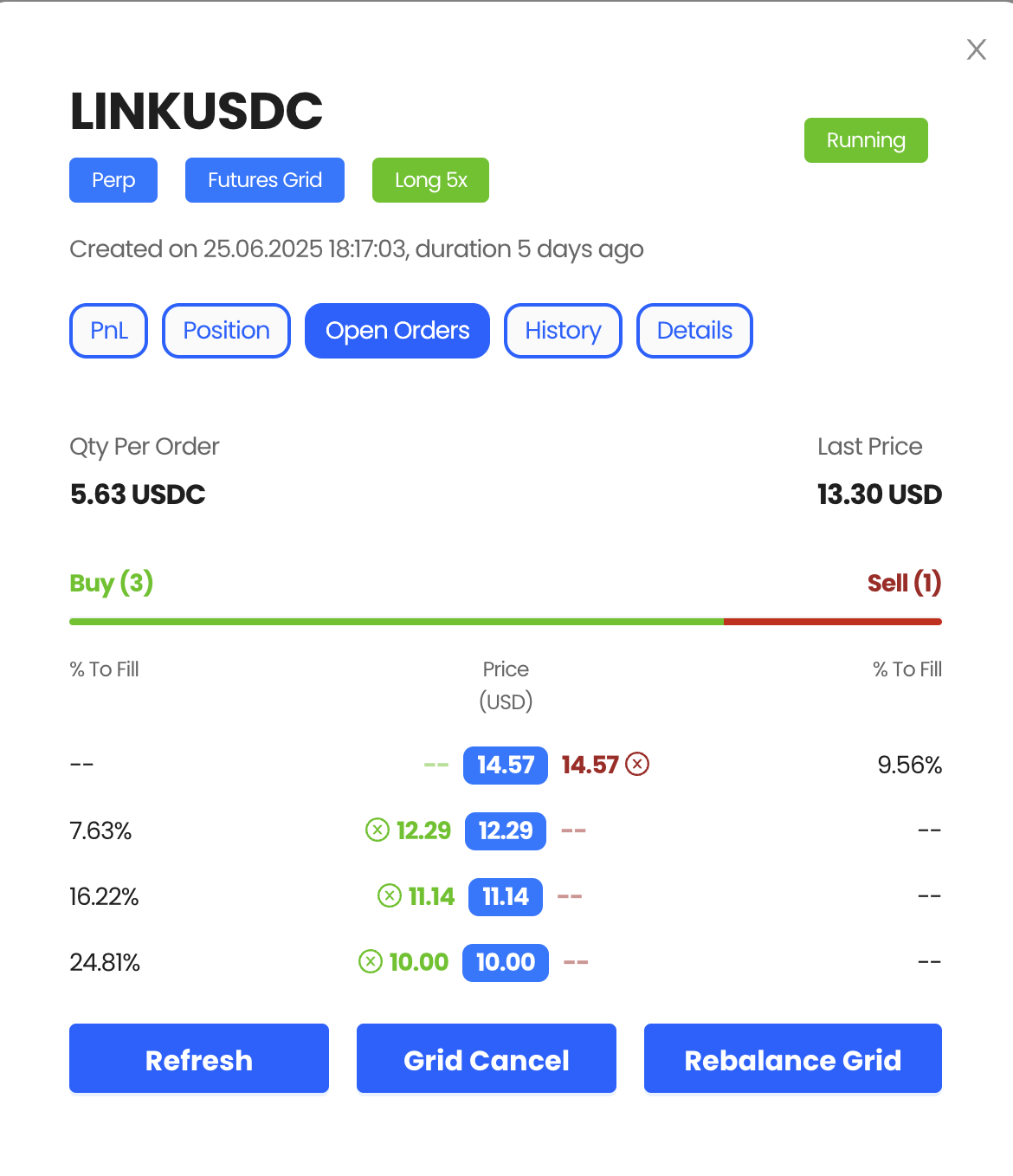

Open Orders

View all currently active buy and sell orders in your grid.

Open Orders Table:

- • Order Type: Buy or Sell order indicator

- • Price Level: Exact price each order will execute at

- • Quantity: Amount of crypto in each order

- • Order Status: Pending, Partially Filled, or Active

- • Time Created: When each order was placed

- • Cancel Option: Manually cancel specific orders

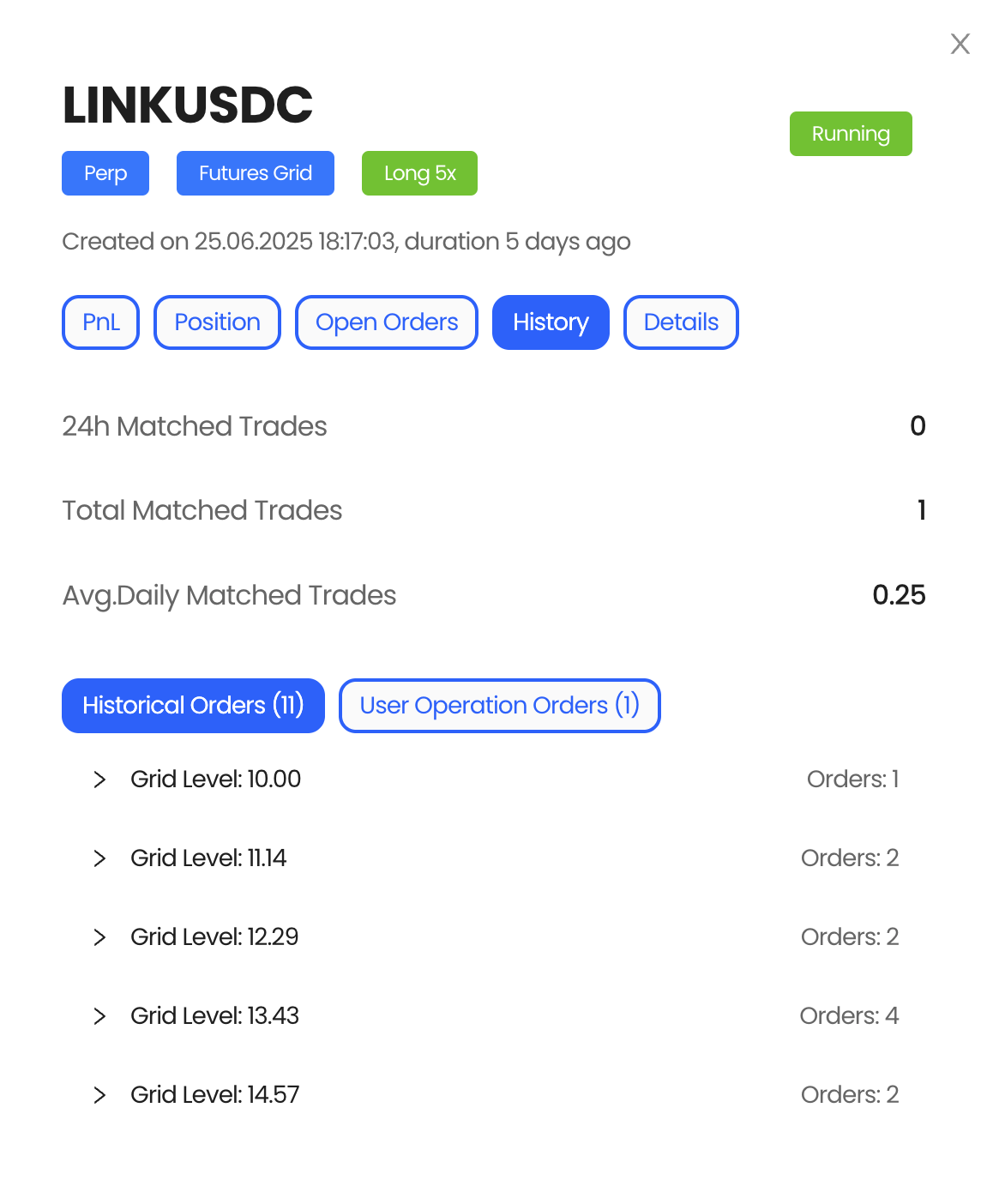

Trading History

Review completed trades and historical performance data.

Trading History Details:

- • Trade Timestamp: Exact time each trade was executed

- • Buy/Sell Action: Type of trade performed

- • Execution Price: Actual price the trade was filled at

- • Trade Profit: Profit/loss from each individual trade

- • Grid Level: Which grid position was triggered

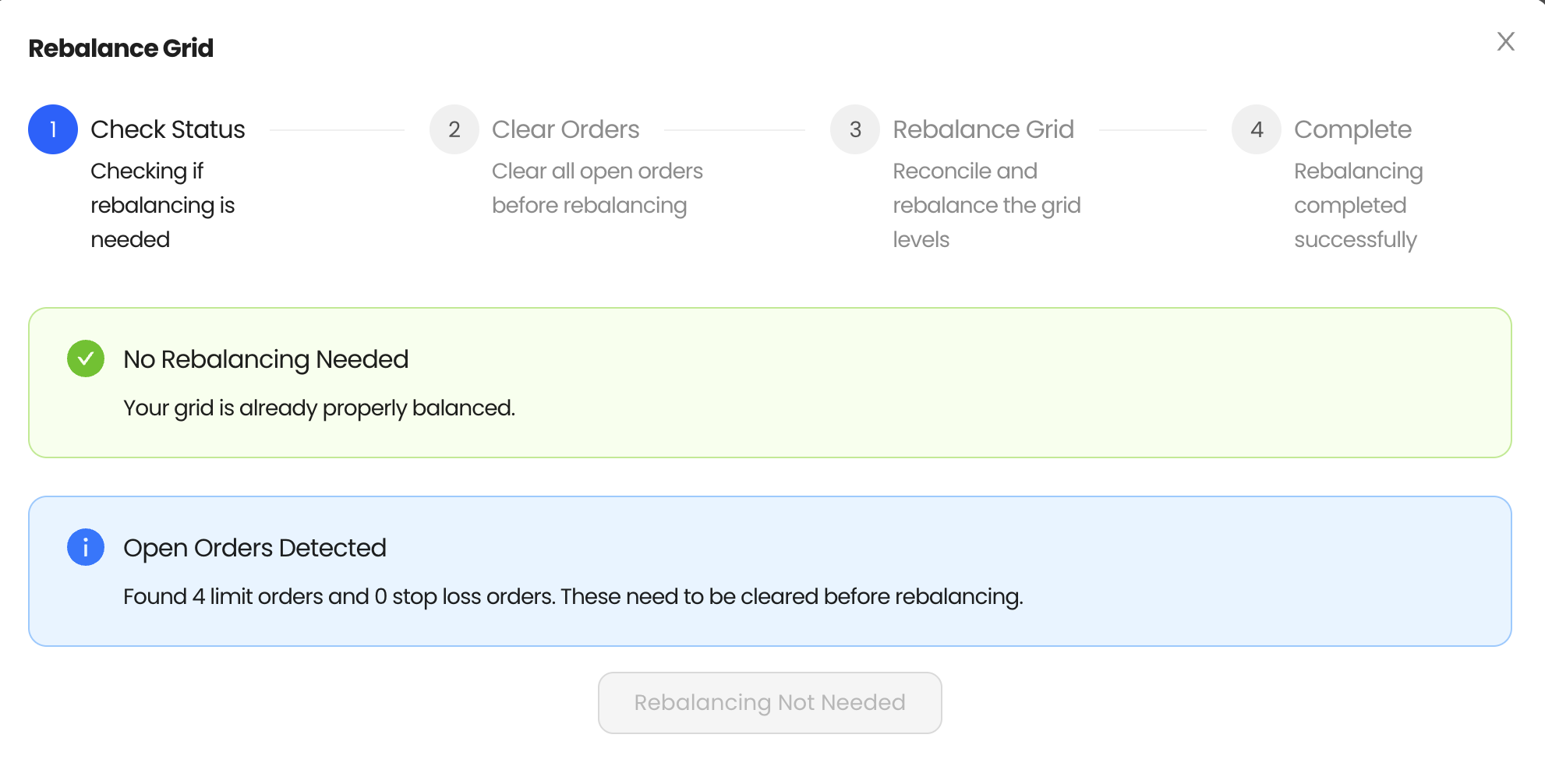

Grid Rebalancing

The bot automatically rebalances the grid based on market conditions, but you can also manually trigger rebalancing when needed.

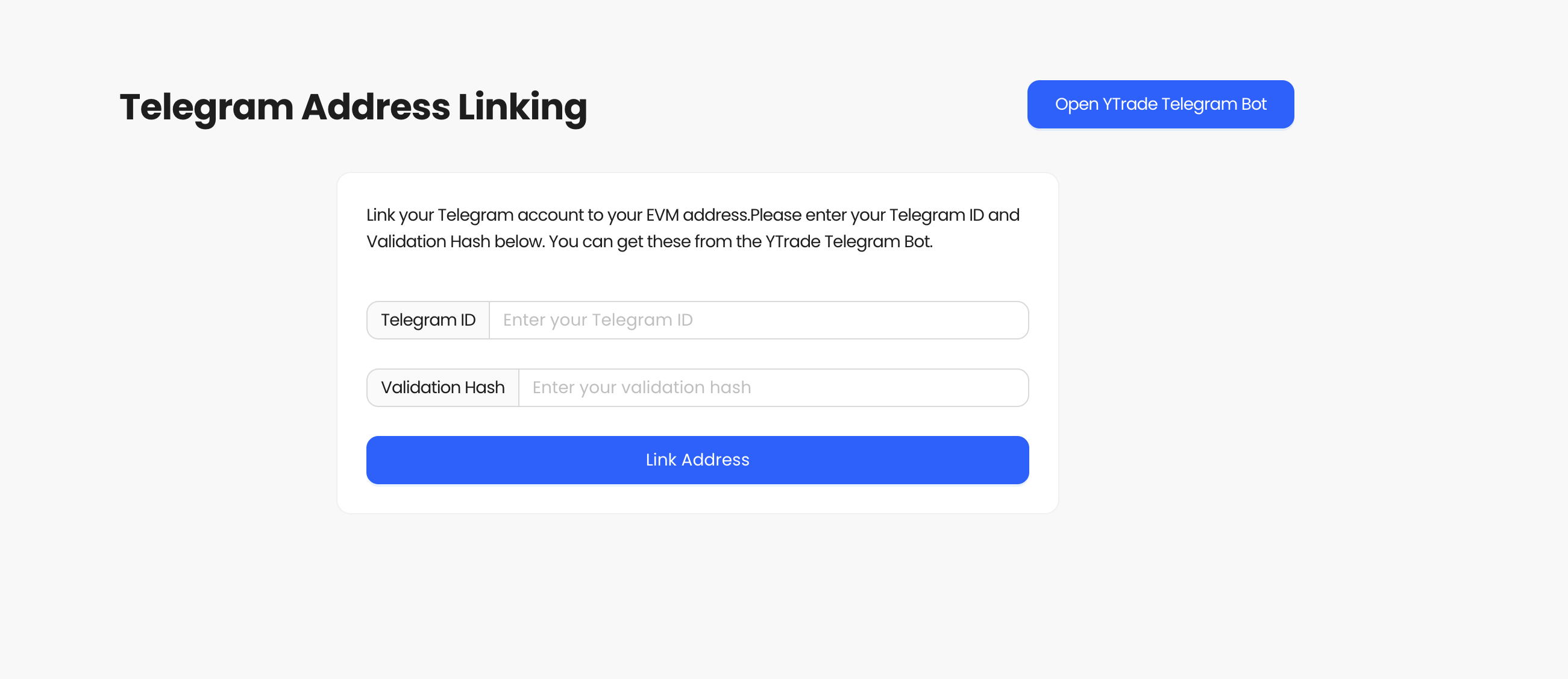

Telegram Integration

Connect your Telegram account to receive real-time notifications about your grid bot's performance, trade executions, and important alerts.

Ending Your Grid Bot

When you want to stop your grid bot, you can safely end it through the interface. This will cancel all open orders and return your assets to your wallet.

Important Notes

- Always ensure you have sufficient balance for grid operations

- Monitor market conditions and adjust grid parameters as needed

- NFT holders get access to advanced features and multiple concurrent bots

- Telegram notifications help you stay informed about bot performance

- Grid trading works best in ranging markets with sufficient volatility

Grow with Yieldflow.

Decentralized, secure and anonymous.

Join thousands of users who are already benefiting from our platform. Start earning passive income on your crypto assets today.

Get Started