Tokenomics

Learn about the YFlow token, its utility, governance, and fee structure.

Tokenomics - YFlow (Utility Token)

The YieldFlow Token ($YFlow) is the governance token of the YieldFlow protocol. It is possible to use $YFlow in the following ways:

$YFlow can be used for governance. Each token holder has an equal weight of proposal power according to the amount of tokens held in his wallet. At a certain threshold, it will be possible to create proposals for the future development of the YieldFlow protocol. Each address holding $YFlow can vote on proposals and actively participate in governance.

$YFlow can be staked in single-asset staking or LP-staking (Uniswap V2 LP positions). Stakers will earn yield in $YFlow tokens in each staking pool. There will be various options in the staking terms according to lockup periods. Longer lockup periods will result in higher yields.

We will use the $YFlow token to ensure future development of the protocol and cover the costs. Initially, $YFlow will be paired against ETH on Uniswap to create the first liquid AMM market with deep liquidity.

Governance Module (GM)

The governance module will consist of two smart contracts:

- Governor Alpha

- Time Lock

The time lock smart contract will become the owner of all smart contracts in the YieldFlow protocol. This will remove the "admin keys" from all contracts and make it only possible to perform any powerful action and upgrade via governance. The time lock ensures that if a proposal passes, the call data is executed after a certain time. The time lock can call any function on any contract through an arbitrary data call.

We will set up the main governance module on Ethereum, but as needed, additional deployments will be made on each EVM chain where YieldFlow operates.

The Governor Alpha module will be a fork of the already audited Compound Protocol smart contract, which is already battle-tested on the ETH main net.

The governor smart contract will create proposals for $YFlow token holders to upgrade governance. In addition to that, $YFlow can vote yes or no on existing proposals. If a proposal passes, the call data will be passed on to the time lock smart contract, where the proposal is then finally executed.

This battle-tested solution of time lock and governance will ensure that YF will evolve into a community ($YFlow holder) owned protocol without any need to trust a third party.

$YFlow Staking Single Staking Contract (YSSC)

$YFlow tokens can be staked in the YSSC contract to generate yield. The yield is an incentive flowing from the protocol treasury. Stakers will get benefits regarding fee reductions and yield generated from the YF protocol smart contracts.

The yield generated from staking in the YSSC will vary regarding the lockup period.

There are three initial staking options:

- Six months lock

- 12 months lock

- 36 month lock

The yield tokens can withdraw at any time and can also be restaked in the YSSC.

The YSSC will also be extended to manage Uniswap V3 positions. Users can stake their V3 positions in the contract. A watcher bot will monitor the borders of the liquidity position per NFT staked in the contract and adjust the borders to be more profitable over time. This way, users do not need to care about adjusting positions as the market price changes. YieldFlow will automate these tasks in combination with a smart contract and achieves significantly higher yields.

For the implementation, the NonfungiblePositionManager contract of Uniswap V3 will be used, allowing users to increase or decrease liquidity per NFT position and rearrange the borders of the liquidity. Additionally, $YFlow-based positions can be staked in the UniswapV3Staker contract, where an incentive program will be created to earn $YFlow tokens.

$YFlow LP Staking Contract

Liquidity provided to $YFlow- xxx pairs will issue liquidity provider (LP) tokens. These tokens will earn trading fees and can be staked in the YFLPSC to earn $YFlow as a reward. There will also be different lockup times, varying in the total amount of rewards paid out to the Stakers over time.

YSSC and YFLPSC will offer view functions that will be consumable by the SMC to determine the amount of reward fees affiliates will get and how much the management fee will be in the case of a withdrawal from the YF protocol.

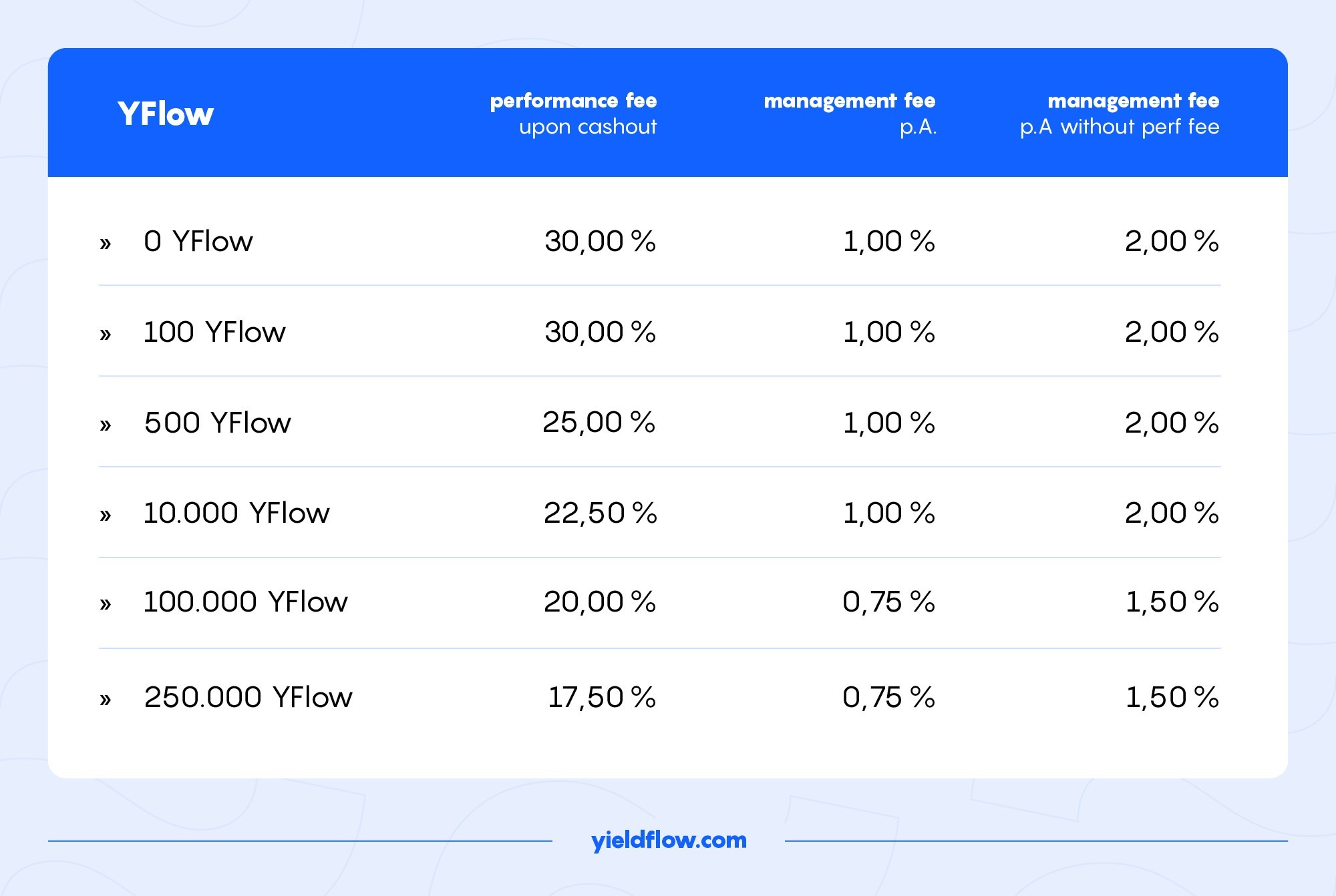

Fee Structure

Our customers will be charged by two different fee types:

All two fee components depend on the YieldFlow Token YFlow. The more you stake, the less you pay. This way, we can reward investors who stay with the project and be sustainable partners.

A performance fee is calculated based on your earnings. It is 100% performance related. If you earn, we earn. Last is the management fee based on your deposit annually.

But we don't keep it, see how you can participate.

Unlike other projects YieldFlow does not take any deposit or withdrawal fees!

Affiliate Program

To motivate our community, we are spreading the spirit and actively promoting the project YFlow. Our YieldFlow Utility Token rewards it. We share up to 90% of our fees with our community. For details, see the table below:

We track your recommendations and reward you with up to 50% of your performance fee and up to 75% of the management fee.

Participating in our project is an essential aspect of YieldFlow. That is why we share most of our income with the YieldFlow community.

The Flow by YFlow

Investing and owning YFlow enriches every digital asset portfolio and elevates it to the next level.

By participating in five different ways, YFlow is a passive flow-generating token:

- Participate in performance fees of up to 25%

- Participate in management fees of up to 75%

- Participate in staking up to 20.50%

- Save own fees in performance fees

- Save own fee in management fees

Bring flow to your portfolio with YFlow.

Utility Token – YieldFlow Token

By our recommendation program, your utility token YFlow enhances the experience by reducing fees and contributing to your flow of yields.

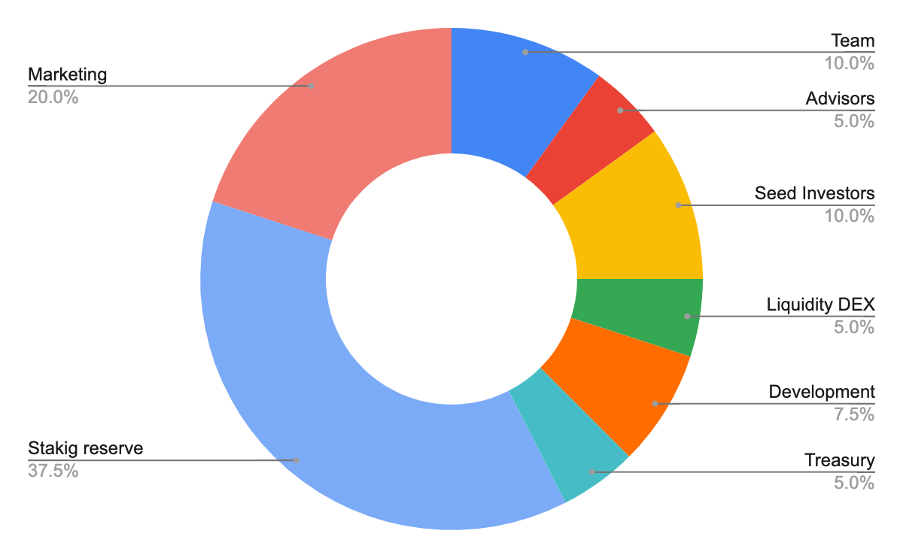

Tokenomics

Yieldflow Token: YFlow

Max supply: 50.000.000

Distribution is as follows:

As stated in the distribution, our essential aim is to run the staking for the community for up to 10 years. This will ensure long-term staking cash flow for our community.

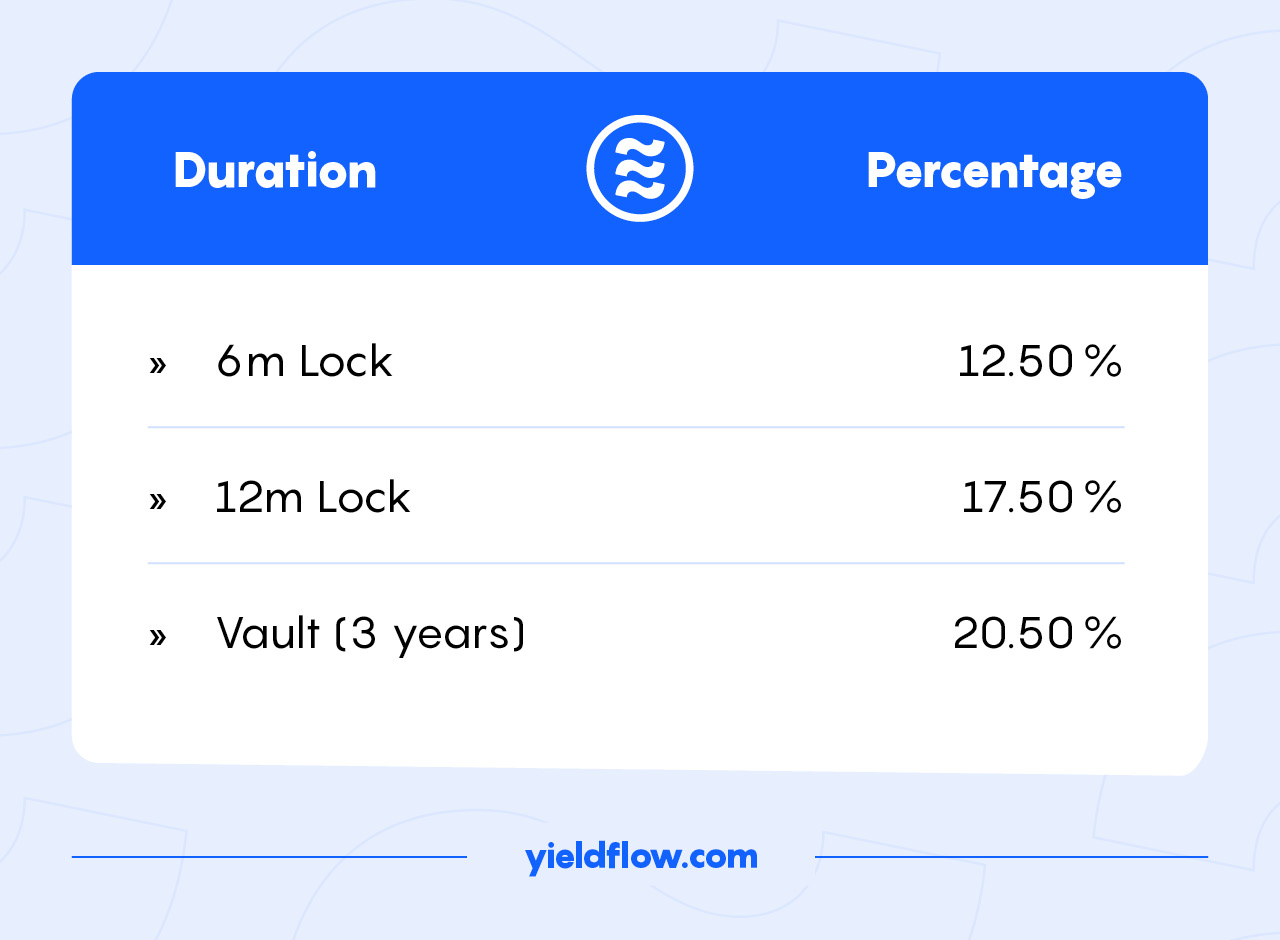

Staking

As mentioned, we followed the sustainable approach at Yieldflow and calculated the Proof of Stake rewards and total supply for ten years.

We offer to stake with three different lock durations, as stated below.

The Vault is for our long-term partners and includes 3 years lock. The staking reward increased significantly based on the 6-month option.

Grow with Yieldflow.

Decentralized, secure and anonymous.

Join thousands of users who are already benefiting from our platform. Start earning passive income on your crypto assets today.

Get Started